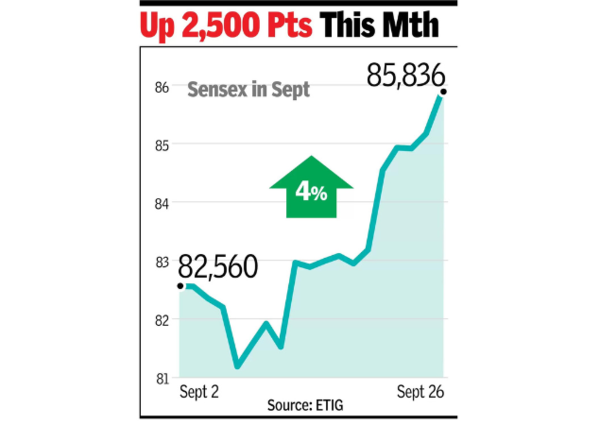

MUMBAI: The sensex rose 666 factors to 85,836 on Thursday, whereas Nifty superior 212 factors to shut at a report excessive of 26,216. The sixth consecutive session of good points was pushed by a rally in auto and steel shares. Whereas automakers surged on hopes that state govts would supply tax cuts and incentives for hybrid autos, steel shares benefited from increased world costs.

The sensex hit an intraday peak of 85,930, and Nifty touched a excessive of 26,251 throughout the day’s session. Of the 30 sensex shares, 28 ended the day in inexperienced, with Maruti, Tata Motors, Bajaj Finserv, Mahindra & Mahindra, and Tata Metal being the highest gainers. L&T and NTPC had been the 2 shares that declined.

“The market is experiencing sturdy liquidity flows. International institutional buyers have turn into patrons in Sept with internet purchases of Rs 24,000 crore. Mutual funds and native buyers are additionally shopping for, and there aren’t any main sellers,” stated Nilesh Shah, MD at Kotak Mutual Fund. Regardless of the sturdy inflows, the rupee weakened barely to 83.64 in opposition to the greenback, down from 83.59, on account of elevated demand for the greenback from importers.

Sector-wise, the auto index surged 2.2%, steel shares gained 2.1%, and others like commodities (1.3%), FMCG (0.8%), and shopper discretionary (0.8%) additionally contributed to the rally. Nevertheless, industrials, telecommunications, and utilities lagged.

In accordance with Shah, liquidity alone can not maintain a rally that was seen in previous bull runs in 1998, 2000 and 2008. “What we at the moment are witnessing is a Triveni Sangam of liquidity, sentiment, and fundamentals. From FY10-20, company income grew at a CAGR of beneath 3% and between FY20-24, income have grown practically 4 instances to Rs 15 lakh crore. When there’s a fourfold progress in income, markets will go up. There may be additionally a sentiment that India’s time has come.”