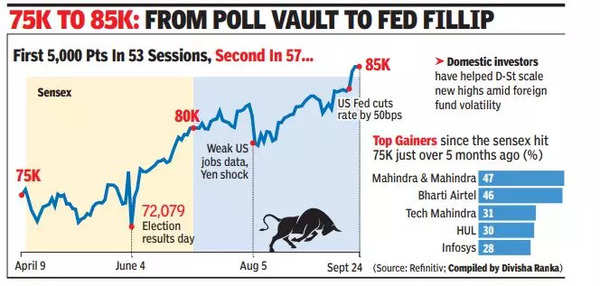

The sensex and Nifty scaled new life-highs in Tuesday’s session, with the previous rallying previous the 85,000 mark for the primary time and the Nifty scaling the 26k peak, earlier than each indices closed barely modified.

Whereas the sensex ended the day at 84,914 – down 15 factors – Nifty ended at 25,940, up simply 1 level. Home funds supported the market whilst international portfolio traders continued to promote throughout the day.The latest surge in benchmark indices has come on the again of the US Fed’s Sept 18 resolution to chop rates of interest by 50 foundation factors .

Sensex hits 85k for 1st time, sprints 10,000 pts in 5 months

Robust promoting by international funds however, the sensex and Nifty scaled new life-highs in Tuesday’s session however closed decrease.

In early trades, the sensex rallied previous the 85k mark for the primary time whereas Nifty scaled the 26k peak in lacklustre commerce in end-session. Whereas the sensex closed at 84,914 – down 15 factors – Nifty ended at 25,940, up simply 1 level. Home funds supported the market whilst international portfolio traders continued to promote throughout the day’s session.

This was the fifth consecutive session of positive aspects and information for Nifty. The latest surge in benchmark indices has come on the again of the US Fed’s Sept 18 resolution to aggressively lower rates of interest by 50 foundation factors (100 foundation factors = 1 share level) on the earth’s largest economic system after greater than 4 years.

“Home benchmarks are trying to maintain new highs, pushed by the US Fed’s aggressive fee lower. In the meantime, the Chinese language central financial institution’s fee lower and extra stimulus measures (this week) have positively influenced world investor sentiment, leading to positive aspects for home metallic shares,” Vinod Nair, head of analysis at Geojit Monetary Companies, mentioned.

In accordance with Nair, robust FPI inflows within the close to time period – pushed by the US Fed’s dovish outlook and expectations of a fee lower by RBI in Oct – are anticipated to take care of momentum within the home market. Nonetheless, some market gamers imagine that after the sensex’s latest rally, from 80k to the 85k stage in lower than three months, there’s robust risk of a consolidation round present ranges. Therefore, the market might see some lacklustre buying and selling classes.

Steel shares witnessed robust shopping for after China introduced financial stimulus packages which can be anticipated to revive demand for metals globally. Among the many main metallic shares, SAIL gained 3.2%, Tata Metal (4.3%), Hindalco (4%) whereas Vedanta closed 3.8% up. Consequently, BSE’s metallic index was up 2.8% – probably the most amongst all sectoral indices on the bourse.

Finish-of-the-session knowledge on BSE confirmed that home funds have been internet patrons at Rs 3,868 crore whereas FPIs internet bought shares value Rs 2,784 crore.