On the interbank international alternate market, the native unit opened at 83.92, then gained floor to the touch 83.88, registering an increase of 9 paise from its earlier shut. File

| Photograph Credit score: The Hindu

The rupee appreciated 9 paise to 83.88 in opposition to the U.S. greenback in morning commerce on Thursday (August 29, 2024), supported by the weak point of the American forex within the abroad market and a optimistic pattern in home equities.

Foreign exchange merchants mentioned the market is awaiting cues from the U.S. Gross Home Product (GDP) and the U.S. Private Consumption Expenditure (PCE) inflation information, as this information level is essential because it may sway the Federal Reserve’s determination on whether or not to implement a 25 or 50 foundation level fee reduce at its September assembly.

On the interbank international alternate market, the native unit opened at 83.92, then gained floor to the touch 83.88, registering an increase of 9 paise from its earlier shut.

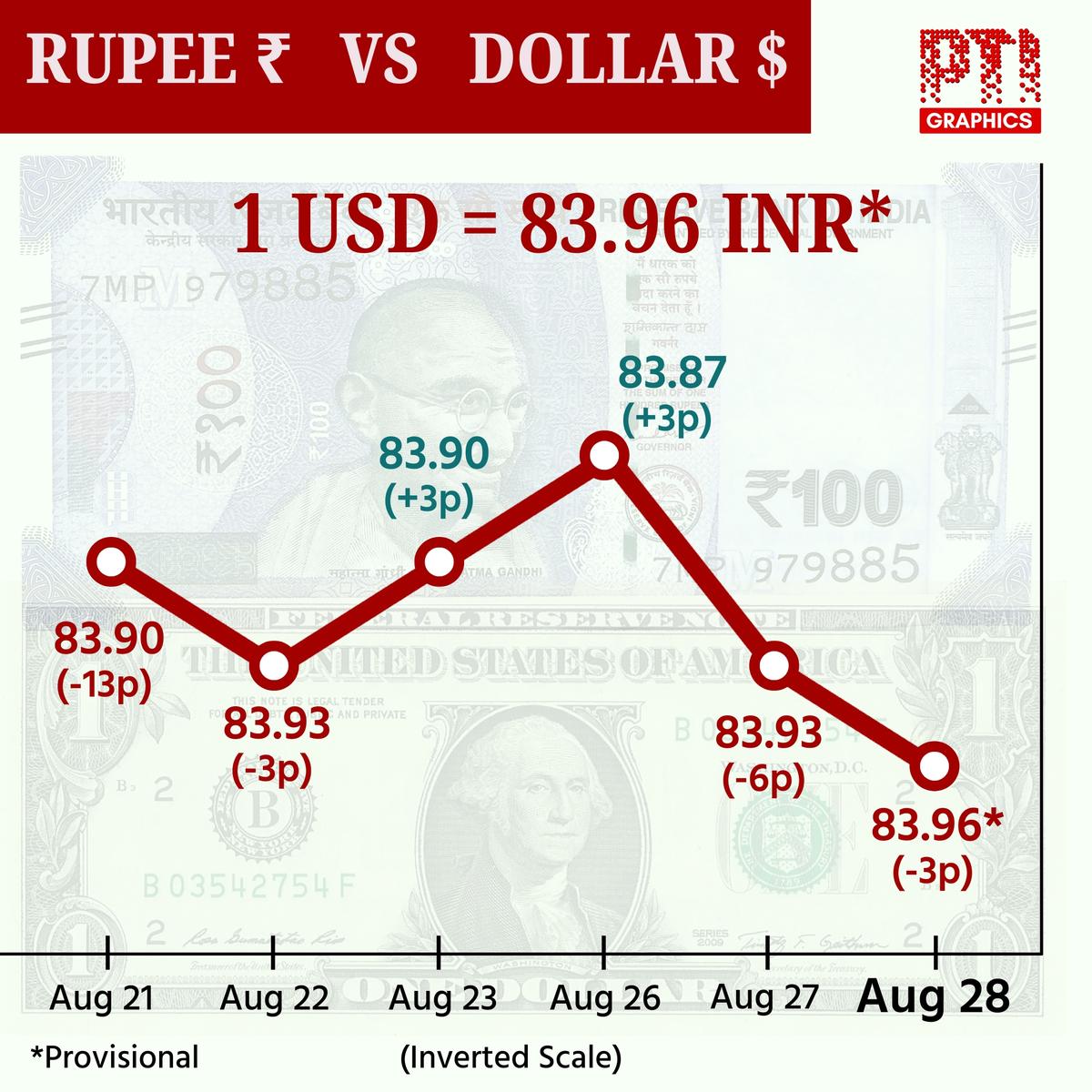

The rupee depreciated 4 paise on Wednesday (August 28, 2024).

| Photograph Credit score:

PTI

On Wednesday (August 28, 2024), the rupee depreciated 4 paise to shut at 83.97 in opposition to the American forex.

“The rupee is within the midst of a tug-of-war between optimistic and detrimental components. With the Reserve Financial institution firmly in management, the rupee is anticipated to commerce inside a slender vary within the close to time period, with the upside probably capped round 83.80 and robust assist close to 84.05,” CR Foreign exchange Advisors MD Amit Pabari mentioned.

“Most Asian currencies have been range-bound because the market awaited the U.S. GDP and PCE information, with IDR at 15412, KRW at 1335 and CNH at 7.1278,” mentioned Anil Kumar Bhansali, Head of Treasury and Government Director Finrex Treasury Advisors LLP.

In the meantime, the greenback index, which gauges the buck’s power in opposition to a basket of six currencies, was down 0.16% to 100.92 factors.

Brent crude, the worldwide benchmark, gained 0.06% to $78.70 per barrel in futures commerce.

Within the home fairness market, the 30-share BSE Sensex superior 211.91 factors, or 0.26%, to 81,997.47 factors, whereas the Nifty was up 52.85 factors, or 0.21%, to 25,105.20 factors.

Overseas Institutional Traders (FIIs) have been internet sellers within the capital markets on Wednesday (August 28, 2024), as they offloaded shares price ₹1,347.53 crore, in response to alternate information.