MUMBAI: Retail stress is are anticipated to stay elevated within the Sept quarter, Yes Bank chief Prashant Kumar mentioned. In keeping with him, the stress is because of aggressive unsecured lending, which led to over-leveraging. Nevertheless, he famous that lending has since slowed.

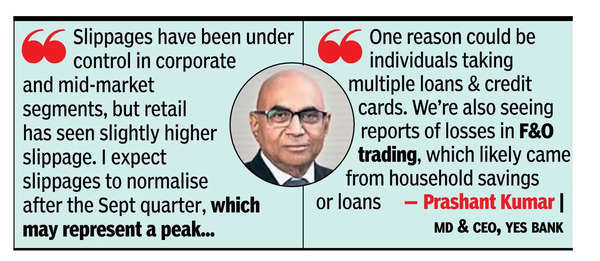

“Slippages have been underneath management in company and mid-market segments, however retail has seen barely increased slippage.I anticipate slippages to normalise after the Sept quarter, which can symbolize a peak,” mentioned Kumar.

He added, “One purpose could possibly be people taking a number of loans and bank cards. We’re additionally seeing studies of losses in F&O buying and selling, which doubtless got here from family financial savings or loans.”

In its first-quarter earnings name, Sure Financial institution acknowledged challenges in its unsecured lending portfolio and mentioned it has carried out coverage modifications for playing cards and loans, pulling again in sure markets and profiles. The financial institution strengthened collections and can restrict unsecured lending progress till assured in all segments.

Kumar defined one of many main drags on the financial institution’s profitability has been the cash invested in RIDF (Rural Infrastructure Growth Fund) to make up for the shortfall in necessary rural obligations. By March 31, there was no shortfall which suggests no further funds will must be invested in RIDF going ahead. Roughly 25% of the funds invested in RIDF, round Rs 11,000 crore out of a complete of Rs 44,000 crore, will begin coming again to the financial institution within the present monetary 12 months. The financial institution continued to be within the lookout for a microfinance firm to amass to satisfy its rural targets however was being cautious on valuations and asset high quality.

The financial institution has successfully managed its price of deposits in order that has not elevated as a lot because the market. To increase its deposit base the financial institution is increasing department community by 40 this 12 months and by 100 a 12 months from FY26 onwards. “Our aim is to develop the deposits at increased price than advances yearly,” mentioned Kumar.

Regardless of the retail challenges, Kumar mentioned that progress alternatives existed in company, SME and mid-market segments and the financial institution was centered on enhancing cost-to-income ratio by way of productiveness positive factors and higher yielding belongings. Sure Financial institution, which trans ferred its unhealthy loans to JC Flowers Asset Reconstruction Firm in lieu of safety receipts has already redeemed half of the SRs following recoveries and was anticipating to get better the remaining loans in two to a few years.

Kumar mentioned that the financial institution’s core fairness is presently at 13.3%, which is kind of a wholesome stage and means they don’t want any further capital for progress functions within the present monetary 12 months. Nevertheless, capital could also be required to fund progress plans within the subsequent monetary 12 months. Whereas the financial institution has approval to lift as much as Rs 2,500 crore in tier-2 capital.