MUMBAI: Neeraj Chopra dazzled all with a wide ranging javelin throw, clinching a silver medal. In the meantime, Manu Bhaker, Sarabjot Singh, Swapnil Kusale, Aman Sehrawat, and the relentless Indian hockey crew introduced dwelling bronze and captured our hearts with their indomitable spirit. These athletes will undoubtedly be showered with money, items, and rewards, whether or not from govt or passionate industrialists providing automobiles, homes, or different perks.And the place there’s earnings, taxes aren’t far behind.

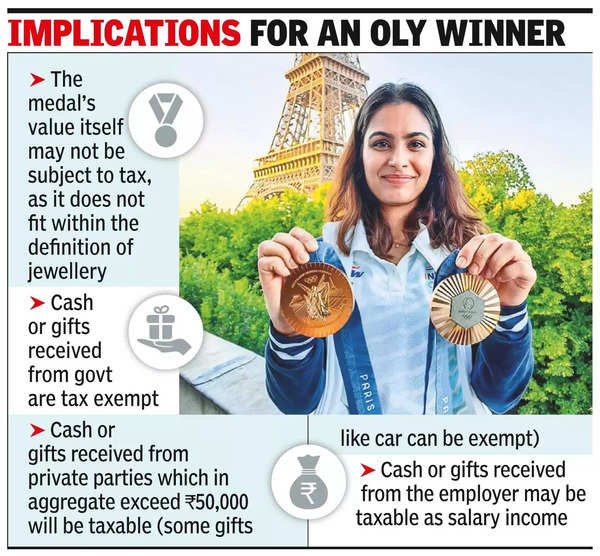

Money or rewards from govt: Media reviews counsel that French medalists will obtain Rs 80,000 for gold, Rs 40,000 for silver, and R s20,000 for bronze from their govt – however tax will likely be withheld. In distinction, Indian athletes take pleasure in a greater deal, as money or items from govt are tax-free.

Central Board of Direct Taxes (CBDT) clarified in a 2014 notification that rewards from the central or state govts to Olympics, Commonwealth, or Asian Video games medalists are exempt underneath Part 10 (17A) of Revenue-Tax (I-T) Act.

Manu Bhaker, who gained two medals at Paris Olympics, and Sarabjot Singh have been awarded Rs 30 lakh and Rs 22.5 lakh, respectively, underneath the reward scheme of ministry of youth affairs and sports activities – these are prone to be tax free. Indian hockey crew’s rewards from Punjab and Odisha state govts will likely be tax exempt too.

In 2018, the Revenue Tax Appellate Tribunal dominated that Rs 96 crore awarded in mixture to shooter Abhinav Bindra, India’s first particular person Olympics gold medalist, was tax exempt because the awards have been from govt.

Is worth of the medal taxable?

Till not too long ago, the US taxed all its medal winners on worth of their medals along with rewards.

Nevertheless, since 2016, owing to Appreciation for Olympians and Paralympians Act, athletes are solely taxed on these if their annual earnings exceeds $1 million. India’s tax legal guidelines do not explicitly handle the taxation of sports activities medals, and the judiciary hasn’t tackled the problem both.

Gautam Nayak, tax associate at CNK & Associates, notes that the important thing query is whether or not a medal constitutes jewelry. He argues it would not, as it is not a each day wearable merchandise like a gold chain or necklace. Part 56(2)(x) of I-T Act states that movable property (as outlined and specified) with out consideration the place mixture worth exceeds Rs 50,000 is taxable. For figuring out “specified items” one turns to the definition, which covers land, buildings, shares, securities, and jewelry – a medal wouldn’t fall in any such class, Nayak says.

Money or items acquired from personal events (together with employer): “Underneath I-T Act, items acquired in extra of Rs 50,000 (in mixture) are taxable underneath the top ‘Revenue from Different Sources’ – worth of a gift-in-kind would have to be declared as earnings and can be taxable on the relevant I-T slab charges,” says Amarpal Singh-Chadha, tax associate and India mobility chief at EY-India. Some industrialists with a purpose to encourage sports activities, do give away items in variety – say a flat or a automobile. As Nayak explains, going by the definition defined earlier a present of a automobile could escape tax.

Some employers give items be it in money or variety to workers who gained a medal. Singh-Chadha provides, “Any reward offered by an employer is taken into account as a perquisite (the place the worth exceeds Rs 5,000). It’s added to the worker’s wage and the worker pays tax on the relevant slab fee in opposition to his taxable earnings. The employer can also be chargeable for deducting tax at supply (TDS) accordingly.”

Based on Nayak an alternate view could possibly be that the reward was in appreciation of the worker’s efficiency on the video games and never associated to his employment. Thus, it will not be taxable as wage – however as earnings from different sources. On this context, as defined earlier, some items in variety might escape tax in the event that they fall outdoors the desired definition.

Worldwide tax comes into play: “If an Olympics medalist earns sponsorship earnings in France throughout the Paris Olympics 2024, the implications underneath India-France tax treaty must be analysed. Such earnings earned in France will likely be topic to tax in France as per its native tax legal guidelines and aid for double taxation, if any, may be claimed by the sportsperson,” says Singh-Chadha.