The BSE sensex surged over 100 factors to cross 85,000-mark for the primary time.

Driving the information

- Each NSE Nifty 50 and S&P BSE Sensex have emerged as two of the best-performing inventory indexes globally in 2024, trailing solely the Nasdaq and S&P 500 within the US.

- The Nifty has surged 18.7% this yr, whereas the Sensex has gained 17%, securing the third and fourth spots amongst main international inventory markets.

- Analysts count on the rally to proceed into 2025, bolstered by international inflows and favorable home financial situations.

Why it issues

- India’s market rally highlights the nation’s rising affect within the international monetary panorama, significantly because it overtakes China in weightage inside a key MSCI index for the primary time.

- With India positioned as one of many world’s most costly rising markets, the sustained upward momentum may entice extra international funding, additional boosting financial development and serving to mitigate international dangers, reminiscent of inflation or geopolitical tensions.

Zoom in

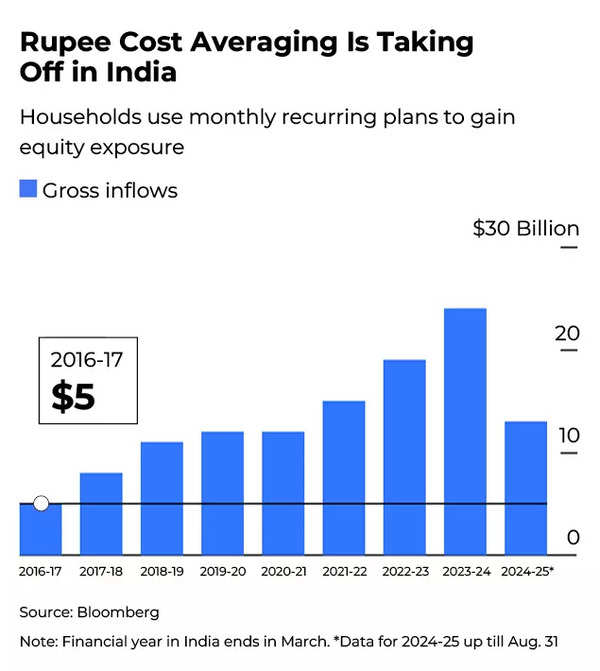

India’s rally is being pushed by a mixture of international portfolio inflows and home retail enthusiasm. Native traders, together with retail and institutional patrons, have bought a web $51 billion in shares this yr alone. This has pushed the markets into overbought territory, elevating considerations about unsustainably excessive inflows, particularly from smaller cities the place traders are more and more directing their financial savings into mutual funds and equities.

Home institutional traders have web bought 3.23 trillion rupees in 2024, with mutual fund contributions hitting file highs for 14 months straight. Nonetheless, analysts at Jefferies warning that inflows of $7.5 billion monthly from home sources are “unsustainably excessive.”

The hinterland awakens

From Indore to Sagar to Kota, there’s a newfound enthusiasm for shares. As per a Bloomberg report, this inventory mania has turn into a nationwide phenomenon that has caught the eye of world monetary powerhouses. Normal Chartered Plc, Barclays Plc, Axis Financial institution Ltd, and 360 One WAM Ltd are among the many companies scrambling to ascertain a presence in India’s second-tier cities.

On the coronary heart of this monetary revolution are individuals like Mukesh Nagar, an electrician in Kota, a metropolis of 1 million individuals. Since 2021, Nagar has been investing 1 / 4 of his modest month-to-month revenue in a inventory mutual fund. “There is no such thing as a higher possibility,” Nagar instructed Bloomberg, embodying the optimism that has gripped small-town traders. “The market will go up ultimately.”

“Should you take a look at the youthful Indians 20 years in the past, their first funding was a financial institution deposit,” Radhika Gupta, chief government officer of Edelweiss Asset Administration Ltd instructed Bloomberg. “At this time, their first funding is thru a month-to-month mutual fund plan.”

This optimism is backed by spectacular numbers. The web wealth of Indian adults has grown at an 8.7% annual fee this century, practically double the worldwide tempo. In smaller cities and cities, the place the expansion fee is even larger, a lot of this new wealth is discovering its means into mutual funds. In accordance with the Affiliation of Mutual Funds in India, individuals residing past the 30 largest metropolitan areas now maintain about 12 trillion rupees ($143 billion) in mutual funds, a 200% improve from 5 years in the past, the Bloomberg report mentioned.

Darkish facet of the growth

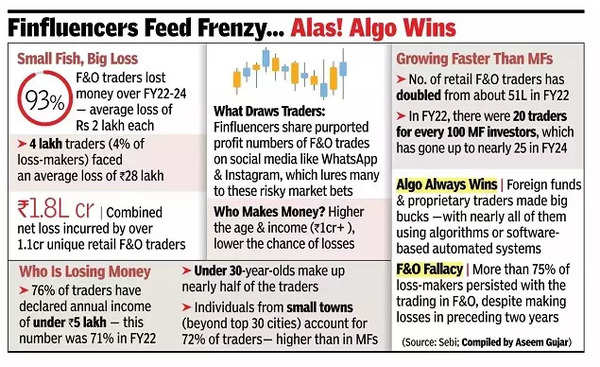

- Whereas the inventory market surge has introduced unprecedented alternatives, it has additionally uncovered the vulnerabilities of

retail traders , significantly within the high-risk futures and choices (F&O) section. A latest examine by the Securities and Alternate Board of India (Semi) revealed a stark actuality: 93 out of 100 retail merchants within the F&O section misplaced cash between FY22-24, with a mean lack of about Rs 2 lakh per individual. - The examine highlighted a regarding pattern amongst younger merchants. Between FY23 and FY24, the proportion of F&O merchants beneath 30 years elevated considerably from 31% to 43%. Alarmingly, practically 93% of those younger merchants incurred losses in F&O in FY24, larger than the common loss-makers of 91.1% in the identical interval.

- In distinction, proprietary merchants and international portfolio traders (FPIs) reaped substantial income, with algo merchants dominating the features. This disparity underscores the necessity for higher monetary training and regulatory oversight as India’s inventory market mania continues to brush via its hinterlands.

- This inventory market mania has not gone unnoticed by regulators. Ashwani Bhatia, a member of the Securities & Alternate Board of India, expressed concern concerning the growth in small-scale IPOs, saying, “We’re very, very frightened.” This warning comes within the wake of a bike dealership with simply two shops and eight workers elevating $1.4 million in a wildly oversubscribed providing.

What’s subsequent

- As India’s inventory market continues its ascent, bolstered by international inflows and favorable home insurance policies, the nation is coming into uncharted territory. Monetary powerhouses like Morgan Stanley are making bullish predictions, with analysts like Ridham Desai drawing parallels to the US 401(ok) growth.

- Desai, Morgan Stanley’s main India strategist, anticipates that the widespread enthusiasm for investing, which is at the moment sweeping via India’s rural areas, may have a profound influence on the nation’s fairness markets.

- In accordance with Desai, this funding fervor may doubtlessly surpass the affect that the introduction of retirement plans had on the US markets. He predicts that this phenomenon might persist for not less than twenty years, doubtlessly resulting in essentially the most extended bull market run ever witnessed in India’s monetary historical past.

- Radhika Gupta, CEO of Edelweiss Asset Administration Ltd., encapsulates the broader transformation going down: “Should you take a look at the youthful Indians 20 years in the past, their first funding was a financial institution deposit. At this time, their first funding is thru a month-to-month mutual fund plan,”Gupta instructed Bloomberg.

- It’s a shift that displays a deeper evolution in how Indians take into consideration wealth—one which stretches far past Mumbai’s monetary elite, into the very coronary heart of the nation.

(With inputs from companies)