Market influence

LVMH reported a big slowdown in gross sales development, with the style and leather-based items unit, its largest division, displaying a mere 1% improve in natural income final quarter.It is a sharp distinction to the 21% development seen a 12 months earlier, leading to a 5.2% drop in LVMH’s shares, erasing a considerable portion of its market worth.

China, a vital marketplace for luxurious items, skilled a 14% decline in gross sales for LVMH within the final quarter. Whereas Chinese language vacationers boosted gross sales overseas, significantly in Japan because of the weak yen, home demand remained weak. This shift has pressured LVMH’s revenue margins as Chinese language shoppers more and more buy luxurious objects abroad to reap the benefits of favorable trade charges.

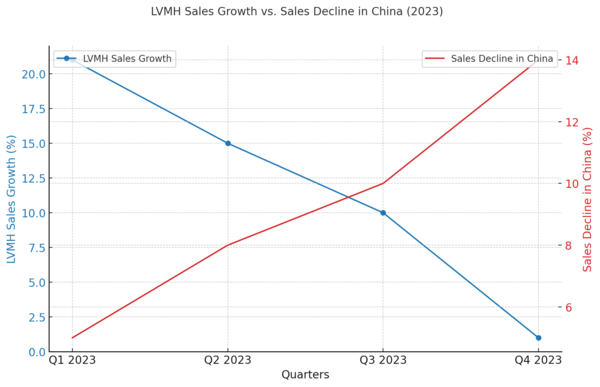

The graph above illustrates the traits in LVMH’s gross sales development versus the decline in gross sales in China all through 2023. The blue line represents the share development in LVMH’s total gross sales, whereas the pink line reveals the share decline in gross sales inside the Chinese language market.

Key observations

LVMH’s gross sales development skilled a big drop from 21% in Q1 to only 1% in This fall.

The decline in gross sales inside China progressively worsened, reaching a 14% decline by This fall.

These traits spotlight the broader challenges confronted by the posh market, influenced considerably by financial slowdowns and altering client behaviors in key markets like China.

Causes of the downturn

Listed below are a number of components which contribute to the droop within the luxurious market:

Financial and geopolitical uncertainty: World financial instability and geopolitical tensions are dampening client confidence and spending energy.

China’s financial slowdown: As one of many largest shoppers of luxurious items, any financial downturn in China considerably impacts international luxurious manufacturers. Altering client habits and elevated abroad spending additional complicate the retail panorama.

How the Ambanis put Indian fashion on the global map

Isha Ambani: The new fashion baroness

Pandemic-era spending increase receding: The luxurious sector loved a surge in spending through the pandemic as prosperous shoppers diverted funds from journey to high-end items. This increase has now plateaued, and the market is adjusting to a post-pandemic regular.

Inflation and market dynamics: Inflationary pressures, significantly in the US, have diminished client spending on non-essential luxurious objects. Different luxurious manufacturers have additionally reported vital declines in revenue and gross sales, citing diminished demand from China and the US.

Penalties for the posh market

The droop in luxurious spending has a number of implications:

Inventory market reactions: Luxurious manufacturers like LVMH have seen vital drops of their inventory costs, affecting their market valuations and investor confidence.

Shift in client behaviour: Customers are more and more buying luxurious items throughout abroad journeys to reap the benefits of weaker foreign currency echange. This pattern impacts home gross sales and pressures revenue margins for manufacturers counting on in-country purchases.

Efficiency disparity amongst manufacturers: Whereas some luxurious manufacturers have weathered the downturn higher, others have reported stagnant or declining gross sales, highlighting various resilience inside the sector.

Operational changes: Corporations are reassessing their operational methods, specializing in effectivity and value administration to take care of profitability.

Market outlook and technique: The luxurious market is prone to see a extra cautious method to enlargement and funding, with manufacturers prioritizing strengthening their presence in resilient markets and innovating to draw and retain shoppers in unstable areas.

World financial turbulence has considerably impacted luxurious giants like Gucci, a part of the Kering Group, and Burberry. Each manufacturers have reported slower gross sales development, significantly in areas that had been beforehand strong. Gucci, as an example, has seen a decline in client demand in North America and Europe, markets which have historically been sturdy. Equally, Burberry has struggled with diminished gross sales in China, a market that has been pivotal to its development technique. These manufacturers are actually reevaluating their market approaches, specializing in sustainability and digital transformation to draw a extra cautious and value-driven client base.

The results of the financial droop are additionally felt by Swiss watchmakers like Rolex and Patek Philippe, recognized for his or her ultra-luxury timepieces. The excessive worth factors of those watches make them significantly delicate to financial fluctuations. As disposable incomes shrink and shoppers prioritize important spending, the demand for such luxurious objects has waned. These manufacturers are adapting by emphasizing restricted editions and unique collections to take care of their attract and justify their premium pricing in a difficult market setting.

The automotive phase of the posh market can also be experiencing a noticeable downturn. Manufacturers like Rolls-Royce and Bentley, which cater to the ultra-wealthy, are witnessing a drop in gross sales as financial uncertainties immediate even prosperous patrons to delay or rethink main purchases. The slowdown in China, one of many largest markets for luxurious automobiles, has significantly impacted these manufacturers. To counteract this, luxurious automakers are diversifying their portfolios with electrical and hybrid fashions, aiming to draw environmentally acutely aware shoppers and adapt to the evolving market dynamics.

Coming again to the style sector, manufacturers resembling Chanel and Prada are feeling the consequences of the worldwide luxurious market droop. Each manufacturers have reported slower gross sales development and are dealing with elevated competitors from rising luxurious manufacturers that attraction to youthful, extra price-sensitive shoppers. The pandemic-induced increase in luxurious items spending has tapered off, resulting in a extra aggressive and difficult market setting. To remain related, these manufacturers are investing in modern advertising methods, increasing their digital presence, and enhancing buyer experiences each on-line and offline. This strategic pivot is crucial for navigating the present droop and securing long-term development in an more and more unstable market.

The luxurious market is dealing with a difficult interval characterised by diminished spending, financial uncertainties, and shifting client behaviors. The information from main luxurious manufacturers highlights the severity of the downturn, significantly because of the financial slowdown in China. The results of this droop are far-reaching, impacting inventory valuations, operational methods, and market dynamics. Transferring ahead, luxurious manufacturers might want to adapt to this new panorama, specializing in innovation, effectivity, and strategic market positioning to climate the storm and emerge stronger.