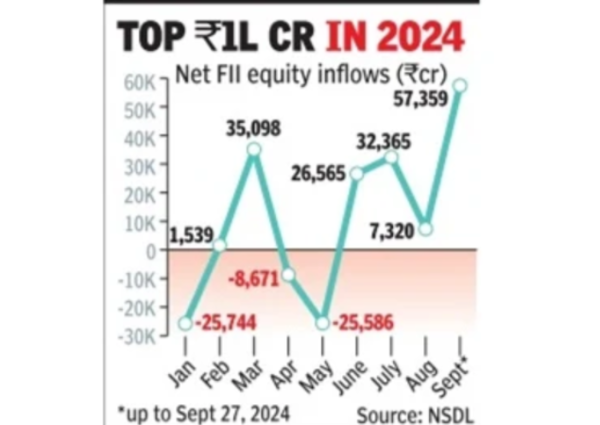

NEW DELHI: International traders have poured Rs 57,359 crore into Indian equities in Sept, making it the best influx in 9 months, primarily pushed by a price reduce by the US Federal Reserve.

With this infusion, overseas portfolio traders’ (FPIs) funding in equities has surpassed the Rs 1 lakh crore mark in 2024, knowledge with the depositories confirmed. FPI inflows are more likely to stay strong, pushed by world rate of interest easing and India’s sturdy fundamentals.Nonetheless, the RBI’s selections, significantly concerning inflation administration and liquidity, will probably be key in sustaining this momentum, Robin Arya, smallcase supervisor and founder & CEO of analysis analyst agency GoalFi, mentioned.

In response to the info, FPIs made a web funding of Rs 57,359 crore in equities till Sept 27, with one buying and selling session nonetheless left this month. This was the best web influx since Dec 2023, when FPIs had invested Rs 66,135 crore in equities.

Since June, FPIs have persistently purchased equities after withdrawing Rs 34,252 crore in April-Might. General, FPIs have been web patrons in 2024, aside from Jan, April, and Might.

A number of components have contributed to the current surge in FPI influx into Indian fairness markets, resembling the beginning of the rate of interest reduce cycle initiated by the US Fed, elevated India weightage in world indices, higher development prospects, and a sequence of enormous IPOs, Himanshu Srivastava, affiliate director — supervisor analysis, Morningstar Funding Analysis India, mentioned.