MUMBAI: The IPO for Manba Finance, a Mumbai-based NBFC that funds two and three wheelers, has been subscribed 224 occasions. The corporate that aimed to mobilise Rs 151 crore now has a requirement for its shares price almost Rs 24,000 crore. That is excluding the Rs 45-crore price of shares allotted to anchor buyers final week.

Excessive web price buyers have been the largest candidates in Manba Finance’s IPO, with the portion reserved for this group subscribed 512 occasions, knowledge on BSE confirmed.The half reserved for institutional buyers was subscribed 149 occasions whereas the one reserved for retail buyers was subscribed 144 occasions. The value band for the IPO, that closed on Wednesday, was Rs 114 to Rs 120 per share. The inventory is anticipated to listing on BSE and NSE on Monday, Sept 30.

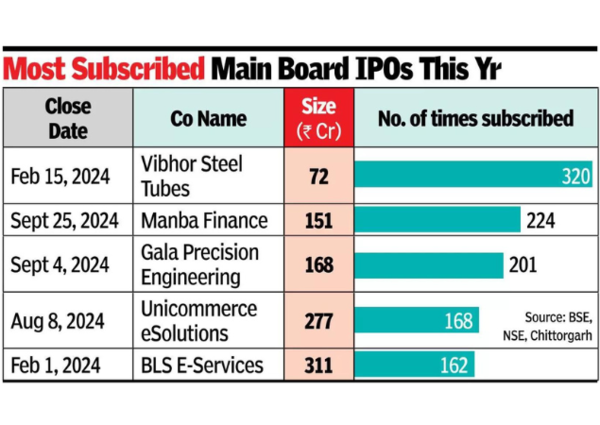

Of late, there was unprecedented rush for IPOs in India. The IPO scene picked up through the later years of the pandemic, within the second half of 2021, and has been displaying a powerful development that’s sometimes called a ‘frenzy’. In comparison with almost Rs 73,100 crore raised in 2023 from 61 predominant board IPOs, these gives have collectively mobilised funds price almost Rs 84,900 crore thus far in 2024, trade knowledge confirmed.

The push to purchase shares in an IPO is at present as widespread within the SME section additionally. Just lately, a two-wheeler dealership with two showrooms and eight staff bought bids price Rs 4,800 crore for a Rs 12 crore provide.

To rein within the frenzy and to save lots of buyers from being duped by unscrupulous buyers, markets regulator Sebi has warned market gamers to watch out earlier than investing in any provide.

NSE, on its half, lately modified guidelines to make it extra stringent for SME corporations to listing on its platform. And BSE officers on Tuesday met about 80 service provider bankers “to debate finest practices that might additional strengthen and smoothen (the) SME IPO itemizing course of,” a spokesperson for the bourse stated.