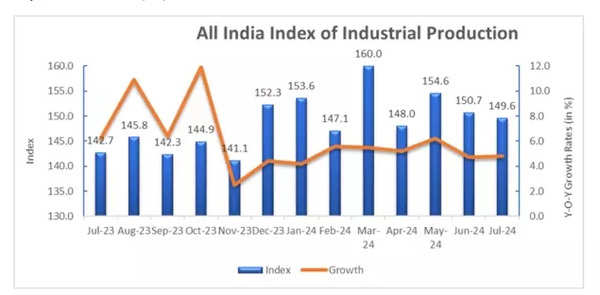

In July 2024, the Index of Industrial Manufacturing (IIP) development price reached 4.8 p.c, a slight enhance from the 4.7 p.c recorded in June 2024.

August CPI Inflation: Key Factors

- In accordance with the Ministry of Statistics and Programme Implementation, that is the second lowest retail inflation prior to now 5 years. The agricultural and concrete inflation charges stand at 4.16% and three.14%, respectively.

- The meals inflation price for August 2024, based mostly on the All India Shopper Meals Value Index (CFPI), is provisionally reported at 5.66%, making it the second lowest since June 2023. The corresponding inflation charges for rural and concrete areas are 6.02% and 4.99%, respectively.

- A number of subgroups, together with ‘Spices’, ‘Meat and Fish’, and ‘Pulses and merchandise’, have skilled a lower in inflation.

Inflation development based mostly on CPI information

Amongst particular person objects, ‘tomato’ has recorded essentially the most vital year-on-year deflation at -47.91% and the most important month-on-month lower in index at -28.8%.

July IIP information: Key factors:

- The three important sectors – Mining, Manufacturing, and Electrical energy – skilled development charges of three.7 p.c, 4.6 p.c, and seven.9 p.c, respectively, for the month of July 2024.

- The Fast Estimates of IIP for July 2024 stand at 149.6, in comparison with 142.7 in July 2023. The Indices of Industrial Manufacturing for Mining, Manufacturing, and Electrical energy sectors are 116.0, 148.6, and 220.2, respectively. Inside the manufacturing sector, the highest three optimistic contributors for July 2024 are “Manufacture of primary metals” (6.4%), “Manufacture of coke and refined petroleum merchandise” (6.9%), and “Manufacture {of electrical} gear” (28.3%).

- In accordance with the use-based classification, the indices for July 2024 are as follows: Major Items at 150.1, Capital Items at 114.4, Intermediate Items at 164.3, and Infrastructure/Development Items at 178.7. The indices for Shopper durables and Shopper non-durables stand at 126.6 and 146.8, respectively.

- The corresponding development charges of IIP as per the use-based classification in July 2024 in comparison with July 2023 are 5.9 p.c for Major items, 12.0 p.c for Capital items, 6.8 p.c for Intermediate items, 4.9 p.c for Infrastructure/Development Items, 8.2 p.c for Shopper durables, and -4.4 p.c for Shopper non-durables.

- The highest three optimistic contributors to the expansion of IIP for July 2024, based mostly on the use-based classification, are Major items, Intermediate items, and Shopper durables.

IIP Development

In the meantime, the Reserve Financial institution of India-led Financial Coverage Committee had saved the repo price unchanged within the final coverage evaluation.

“The MPC could look by way of excessive meals inflation whether it is transitory; however in an setting of persisting excessive meals inflation, as we’re experiencing now, the MPC can not afford to take action. It has to stay vigilant to forestall spillovers or second spherical results from persistent meals inflation and protect the features made to date in financial coverage credibility,” mentioned RBI governor Shaktikanta Das within the August Financial Coverage evaluation.