Authorities remaining consumption expenditure tanked 0.2% in Q1, whereas public capital expenditure spends that embrace tasks financed by the Centre, States and central public sector companies, had been 33.3% decrease than a yr in the past.

| Picture Credit score: Getty Photos/iStockphoto

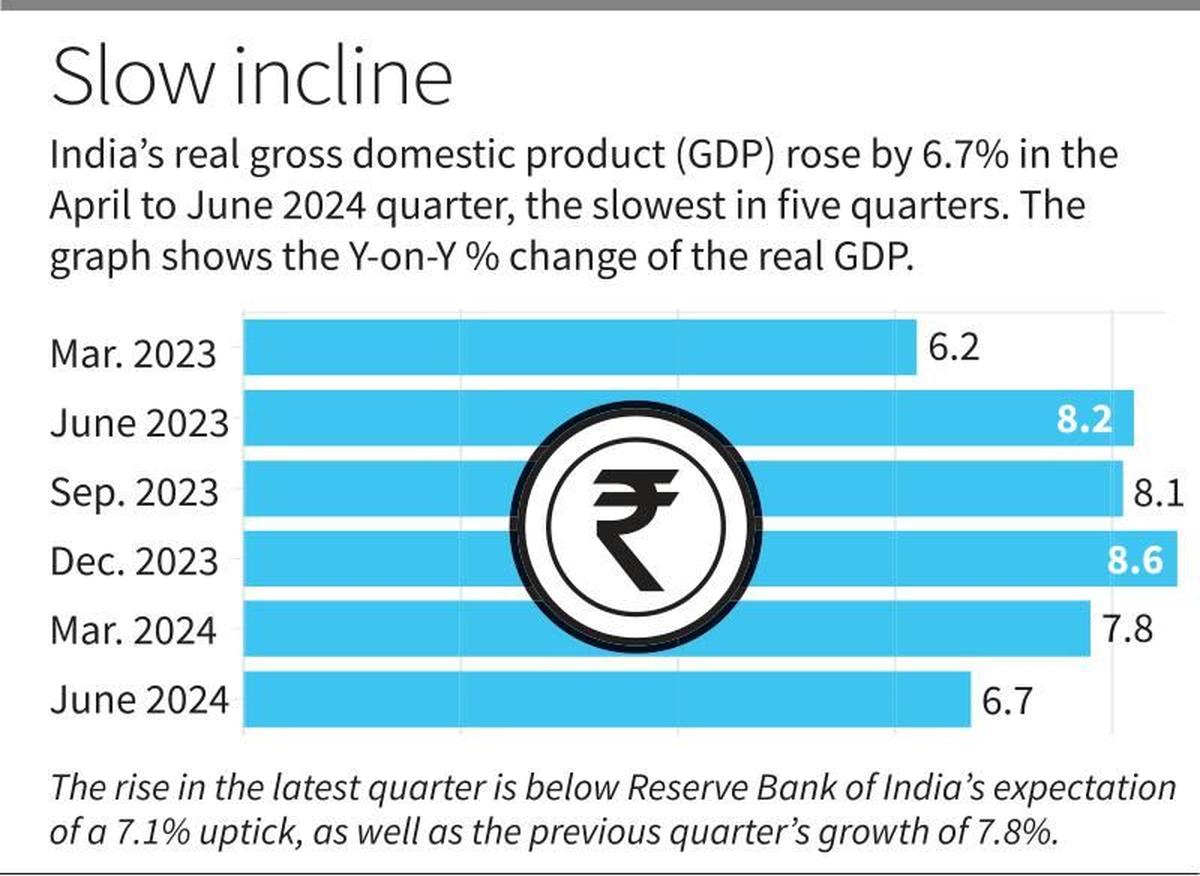

Signalling a moderation within the financial system’s development momentum, India’s actual GDP rose 6.7% within the April to June 2024 quarter, the slowest in 5 quarters, and effectively beneath the Reserve Financial institution of India’s expectation of a 7.1% uptick in addition to the 7.8% uptick registered within the previous quarter.

For the primary time in a yr, development in the true Gross Worth Added (GVA) within the financial system outperformed GDP development, with a 6.8% uptick within the first quarter (Q1) of 2024-25. This can be a important shift from the previous two quarters, Q3 and This autumn of 2023-24, when actual GVA development lagged GDP development by 1.8 and 1.5 share factors, respectively.

The central financial institution has penned in a GDP development of seven.2% for this yr, and the softer than anticipated Q1 development amid easing headline inflation might shift the dynamics for its hawkish financial coverage stance, particularly with the U.S. Federal Reserve indicating an rate of interest minimize subsequent month.

Chief Financial Advisor V. Anantha Nageswaran sought to minimize the Q1 blip as “a slight slowdown that was anticipated by most commentators” because the conduct of the final elections had introduced down authorities expenditure, together with capital spends.

“So in that sense, the 6.7% [growth] was effectively inside the consensus anticipation. On the identical time, there’s a higher alignment between the demand and provide aspect of the financial system, and plenty of elements of the demand aspect, reminiscent of remaining personal remaining consumption expenditure, gross fastened capital formation and internet exports have held up fairly effectively,” he stated. The two% rise in farm sector GVA in Q1 signifies a turnaround from current quarters’ lows, such because the 0.6% rise in January-March 2024, he famous.

Authorities remaining consumption expenditure tanked 0.2% in Q1, whereas public capital expenditure spends that embrace tasks financed by the Centre, States and central public sector companies, had been 33.3% decrease than a yr in the past. Nonetheless, gross fastened capital formation grew 7.5%, recovering from a four-quarter low of 6.5% within the earlier quarter, and personal consumption outgoes appeared to rebound from final yr’s weak traits to hit a six-quarter excessive of seven.4%.

“The key elements aside from public sector for capex are households and the personal sector. A stagnation within the public sector capex together with a gradual capex by the family sector signifies a modest pickup within the personal sector capex,” stated Paras Jasrai, senior financial analyst at India Scores and Analysis.

“This GVA development in Q1 has been pushed by important development within the Secondary Sector (8.4%), comprising Building (10.5%), Electrical energy, Gasoline, Water Provide & Different Utility Companies (10.4%) and Manufacturing (7%) sectors,” the Nationwide Statistical Workplace stated.

On the providers aspect, nevertheless, development within the job-intensive ‘Commerce, Resorts, Transport, Communication & Companies associated to Broadcasting’ phase dropped to five.7% from 9.7% in the identical quarter final yr, whereas ‘Monetary, Actual Property and Skilled Companies’ eased to 7.1% from 12.6% a yr in the past. Economists attributed a few of this to statistical base results.