Benchmark BSE Sensex rose by almost 286 factors to shut at a document excessive whereas Nifty settled above 24,950 degree on Wednesday, extending their successful run to the fourth day on positive factors in metallic, energy and choose auto shares.

The 30-share BSE Sensex settled larger by 285.94 factors or 0.35% at 81,741.34, its all-time closing excessive, with 20 of its elements advancing and 10 ending decrease. The index opened larger and jumped 372.64 factors or 0.45% to hit an intra-day excessive of 81,828.04.

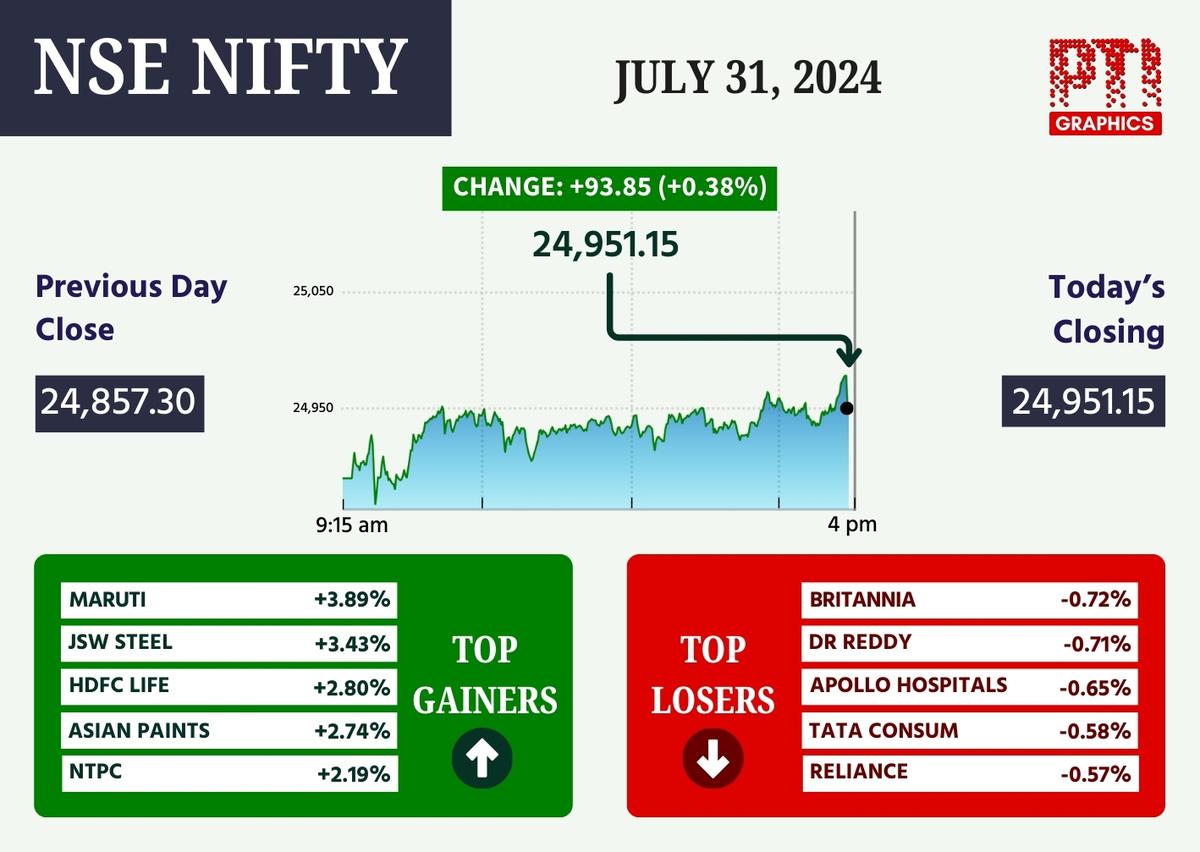

The NSE Nifty rose 93.85 factors or 0.38% to shut at an all-time excessive of 24,951.15. Through the day, it surged 127.3 factors or 0.51% to hit a excessive of 24,969.35.

This graph reveals how the Sensex carried out on July 31, 2024.

| Picture Credit score:

PTI

This graph reveals how the Nifty carried out on July 31, 2024.

| Picture Credit score:

PTI

“The home market is making an attempt to cross above the psychological threshold of 25,000, as subdued Q1FY25 earnings and stretched valuations are curbing the problem, whereas constructive international traits and sector rotation are supporting the traction,” Vinod Nair, Head of Analysis, Geojit Monetary Companies mentioned. Optimistic international sentiment pushed by expectations of an easing rate of interest cycle by the U.S. Fed and the RBI within the medium time period, owing to benign inflation, ignited the rally, he added.

The market capitalisation of BSE-listed corporations jumped to a life-time peak of ₹462.38 lakh crore ($5.52 trillion) on July 31 helped by a four-day rally in benchmark indices, making buyers richer by ₹5.45 lakh crore.

High gainers

Among the many Sensex shares, JSW Metal, Asian Paints, Maruti Suzuki India, NTPC, Adani Ports and Particular Financial Zone, Bharti Airtel, ITC and Tech Mahindra had been the key gainers.

Maruti Suzuki rose by 2.28% because the auto main reported a 47% soar in its web revenue for the June quarter. Reliance Industries, Tata Motors, Infosys, Mahindra and Mahindra, Bajaj Finance and Axis Financial institution had been the laggards.

On the market shut, the BSE smallcap gauge fell 0.14% within the broader market. Nonetheless, BSE MidCap gauge jumped 0.86%. Through the day, each the indices hit their all-time excessive degree. Among the many indices, Utilities surged (1.57%), adopted by Energy (1.46%), Steel (1.12%), Healthcare (0.91%) and Commodities (0.74%). Power, Telecommunication and Realty had been the laggards.

Within the broader market, Torrent Energy shares zoomed almost 17% to complete at ₹1,867.10 per piece on the BSE. Additionally, Omaxe shares fell 5% on the BSE after SEBI barred the actual property agency, its Chairman Rohtas Goel, MD Mohit Goel and three others from the securities marketplace for two years for irregularities within the firm’s monetary statements.

Prashanth Tapse, Senior VP (Analysis) at Mehta Equities, mentioned Nifty ended comfortably within the inexperienced forward of the FOMC final result, closing simply shy of the psychological 25,000 mark, signifying the bulls’ continued energy on Dalal Road. Traders now await key knowledge releases and the FOMC final result, with expectations set on Jerome Powell’s commentary, he mentioned.

U.S. Fed to announce its coverage stance later right now

As anticipated, the Financial institution of Japan raised its rate of interest an now all eyes are on U.S. Fed coverage to be introduced later within the night.

The U.S. Federal Reserve (Fed) will announce its fifth rate of interest choice for this 12 months later within the evening, after a two-day assembly of the Federal Open Market Committee (FOMC). From this assembly, the Fed may provide hints a couple of potential charge reduce in September.

“Indian shares started Wednesday on a constructive word, buoyed by robust cues from different Asian markets amid expectations for added stimulus measures from Beijing to help its ailing economic system,” Avdhut Bagkar Technical and Derivatives Analyst at StoxBox, mentioned.

The European markets had been buying and selling within the inexperienced territory whereas Asian markets settled larger. Wall Road closed on a combined word on Tuesday. World oil benchmark Brent crude rose 1.88% to $80.51 a barrel.

Overseas institutional buyers offloaded equities value ₹5,598.64 crore on July 31, in line with trade knowledge.