MUMBAI: Sebi has made it more durable for people to take part in fairness derivatives buying and selling by elevating the entry barrier when it comes to contract measurement, and requiring upfront charges and costlier roll-overs.

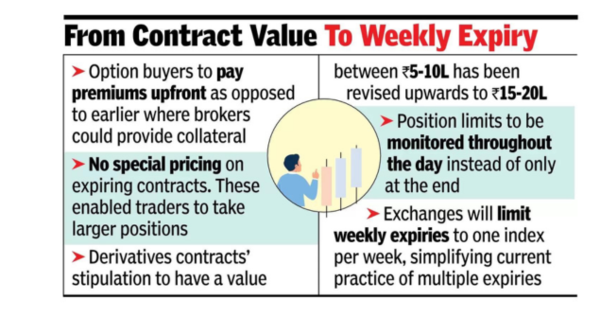

Below the brand new laws, choice consumers should pay premiums upfront, changing the apply the place brokers have been allowed to supply collateral. Sebi has additionally completed away with the particular pricing on expiring contracts that enabled merchants to take bigger positions.Each practices, which allowed buyers to promote an expiring choice and purchase a longer-term one with decrease margins, will take impact from Feb 1, 2025.

Noting that the present stipulation that index derivatives should have a contract worth between Rs 5-10 lakh was set in 2015, Sebi stated that derivatives contracts henceforth shall have a worth between Rs 15 lakh to Rs 20 lakh. The lot measurement may also be adjusted in order that the contract worth stays throughout the new bracket throughout opinions.

Sebi will monitor place limits all through the day as an alternative of solely on the finish to regulate the excessive buying and selling exercise, particularly on expiry days. Exchanges will restrict weekly expiries to 1 index per week, simplifying the present apply of a number of expiries.

Chatting with TOI, Dhirendra Kumar, CEO of Worth Analysis, stated, “Not like fairness, which by definition has to generate a greater return than fastened revenue over time, derivatives are a zero-sum sport, and it’s virtually all the time the person investor who loses. Sebi ought to introduce a statutory warning illustrating the chance of losses, similar to with cigarettes.” He added that whereas in fairness, the dangers are of worth volatility and the failure of particular person firms – which will be addressed by long-term investing and diversification – derivatives are an pointless threat for people. “Brokerages faux to earn money by promoting shares, however their enterprise mannequin is such that income comes from F&O, and so they must shut store if buyers solely purchased and held shares,” he famous.

Not too long ago, a Sebi research discovered that 93% of over 1 crore particular person F&O merchants incurred common losses of round Rs 2 lakh every between FY22-24, totalling over Rs 1.8 lakh crore. The share has gone up from 89% in FY22.