MUMBAI: There was a pointy selloff on Dalal Avenue on Monday with the sensex and Nifty each sliding practically 1.5%, marking their steepest single-day drop since Aug 5.

The sensex opened 363 factors decrease, following a crash in Japan’s Nikkei, and remained below stress all through the day as world investor focus shifted to China after Beijing’s new stimulus measures.Rising geopolitical tensions with Israel stepping up strikes in Lebanon too unsettled traders.

The sensex ended the day down 1,272 factors at 84,300, whereas Nifty closed at 25,811, logging a 368-point decline. Traders continued to e book earnings, notably in the important thing IT and monetary sectors, contributing to the market’s downturn.

Out of the key sectors, 12 of 13 closed within the crimson, with monetary providers shares dropping 1.7%, IT shares falling 0.9%, and Reliance Industries slumping 3.3%, reversing good points from its prior two classes. Reliance’s decline alone worn out Rs 66,820 crore from its market valuation. The market capitalisation of BSE-listed corporations fell by Rs 3.6 lakh crore to Rs 474.4 lakh crore. The metals index, nonetheless, stood out, rising 1.3% for the seventh straight session, buoyed by rising world costs and stimulus measures from China.

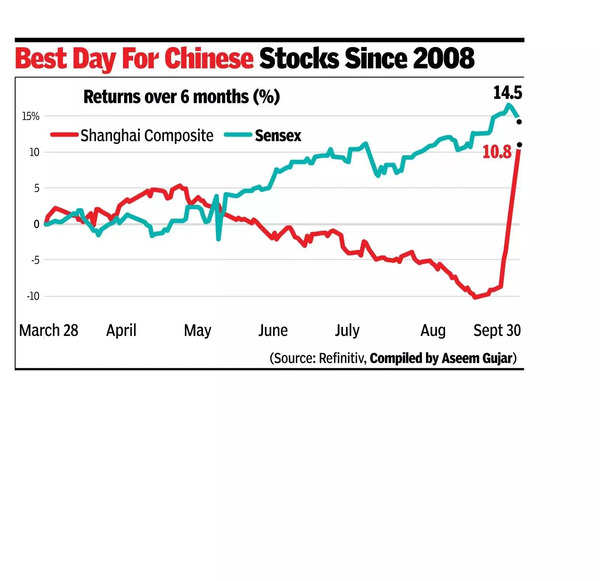

On Monday, Japan’s Nikkei 225 index dropped practically 5%, whereas the Shanghai Composite surged 8% on recent stimulus bulletins, additional influencing investor behaviour. Japanese markets crashed because the incoming PM, Shigeru Ishiba is seen as a financial hawk supporting a stronger Yen, which is unfavorable for commerce and markets. With a Sebi board assembly scheduled for Monday, markets had been rife with rumours on the motion the regulator would take. These included a curb on futures and choices commerce which might hit market liquidity.

“Regardless of the downturn, sectors like shopper durables and vehicles may even see elevated demand throughout the upcoming festive season, though rising inflation might mood progress. Consideration may also be on key financial knowledge releases within the coming weeks, together with: Infrastructure Output, Present Account Stability, Manufacturing PMI, WPI Inflation. Moreover, upcoming RBI coverage selections might considerably affect market route.” Mentioned Vikram Kasat of Prabhudas Lilladher.

The rupee dropped 0.1% towards the greenback on Monday, closing at 83.79, down from its earlier shut of 83.7. The decline was pushed by greenback demand from international banks. Regardless of Monday’s fall, the rupee posted its finest month since June, gaining 0.1% for the month. International inflows into Indian shares and bonds, totalling practically $11 billion in Sept, helped strengthen the rupee over the month, marking the very best internet month-to-month inflows on document.