MUMBAI: In a transfer that may make shares among the many most liquid investments, markets regulator Sebi has proposed increasing the scope of T+0 settlement cycle to 500 shares, from 25, in a phased method, permitting traders to get their cash on the day they execute the transaction.

The board of the regulatory company, which met for the primary time since allegations have been levelled in opposition to Sebi chief Madhabi Puri Buch, additionally cleared different main initiatives together with a brand new asset class for high-net value people that lies between mutual funds and portfolio administration schemes.’Funding Methods‘ will include a minimal funding of Rs 10 lakh.

It should curb the rise of unauthorised schemes, promising unrealistic returns, and comes with safeguards resembling no leverage, restrictions on investments in unlisted and unrated devices, and restricted derivatives publicity.

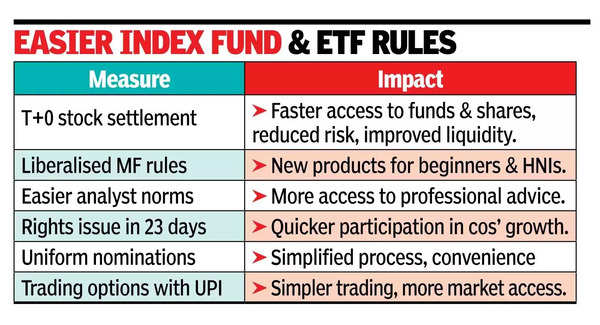

To encourage passive funding, the regulator has additionally cleared ‘MF Lite’, a framework with relaxed rules for passively managed schemes like index funds and ETFs. Based on Sebi a neater regulation is justified because the asset administration firm has negligible discretion in such schemes. That is anticipated to make it simpler for brand spanking new fund managers to enter the market and provide passive funding choices to traders. Additional selling ease of funding, Sebi has eased the regulatory framework for funding advisers and analysis analysts, lowering qualification necessities and inspiring extra people to enter these professions. Within the major market, Sebi will streamline rights problem processes to 23 working days, making it one of many quickest methods for an organization to boost capital.

The choice to develop the scope of the T+0 cycle is seen as a serious change, which was first launched in a small set of shares, however the regulator determined to extend the ambit following a profitable preliminary deployment, making India maybe the one giant market to supply this type of liquidity to traders.

All registered stockbrokers can now provide this to their shoppers, doubtlessly charging completely different brokerage charges for it. Certified Inventory Brokers (QSBs) and custodians might want to replace their techniques to help T+0, with a versatile implementation timeline. It will enable establishments like FPIs and mutual funds to take part in T+0 settlement. Moreover, a brand new block deal window will likely be launched for T+0 trades. Nonetheless, the transfer to instantaneous settlement is on maintain, and T+0 will proceed to co-exist with the usual T+1 settlement.

The regulator has additionally launched a relaxed regulatory dispensation for index fund managers. The much-anticipated board assembly, nonetheless, didn’t evaluate the futures & choices rules and the 23-page assertion was silent on discussions on HR points.

For traders, Sebi has launched new buying and selling choices, giving traders the selection to commerce within the secondary market utilizing both the UPI block mechanism or a 3-in-1 buying and selling account facility, simplifying the buying and selling course of and enhancing investor comfort. Different measures embody making certain pro-rata rights for traders in different funding funds.