MUMBAI: India topped the international IPO market with 227 transactions totalling $12.2 billion within the first eight months of 2024. This was led by robust market sentiment, a sturdy macroeconomic setting, and a surge in investor curiosity fuelled by worry of lacking out, knowledge and analytics agency GlobalData stated on Friday.

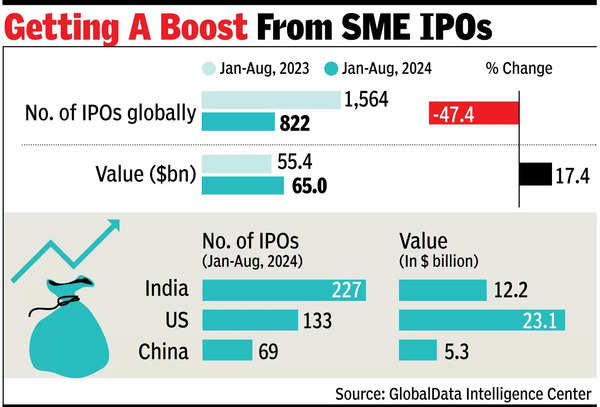

The Asia-Pacific area recorded the most important variety of transactions, totalling 575, amounting to $23.7 billion in worth, whereas North America had 149 offers valued at $25.4 billion, knowledge confirmed.India topped with 227 transactions valued at $12.2 billion, primarily as a result of the next variety of SME IPOs. The US got here in second with 133 offers of $23.1 billion, whereas China ranked third with 69 transactions value $5.3 billion.

In India, each the SME and mainboard IPO segments have contributed to the surge, supported by robust demand from native retail buyers and establishments, the information confirmed. Whereas the variety of IPOs globally declined within the first eight months of 2024, the whole deal worth noticed a major surge, in keeping with the information.

Getting a lift from SME IPOs

A complete of 822 IPOs had been registered with an combination deal worth of $65 billion, reflecting a 17.4% rise in worth in comparison with the $55.4 billion from 1,564 listings throughout the identical interval in 2023. GlobalData stated this means a shift in the direction of bigger, extra precious IPOs.

“The IPO market underwent a major uptick in exercise in 2024 as macroeconomic situations stabilised and there was a resurgence in non-public fairness and enterprise capital-backed listings. Investor sentiment in the direction of equities, notably IPOs, continued to enhance, buoyed by the robust after-market efficiency witnessed in 2023,” stated Murthy Grandhi, analyst at GlobalData.

The sectors main the best way in IPO exercise had been expertise and communications, registering 135 transactions with a complete worth of $6.4 billion. Following carefully had been monetary providers, with 113 offers ($11.6 billion), development with 79 transactions ($3.9 billion), and prescribed drugs and healthcare with 75 offers ($7 billion), in keeping with the database.

“The trajectory of the IPO market will proceed to be influenced by a posh set of things, together with shifts in financial coverage, geopolitical developments, and evolving investor preferences… Amidst these, corporations that display robust monetary fundamentals and clear development can attraction to an more and more selective investor base. The power to showcase resilience and long-term sustainability will likely be key for companies in search of to draw capital on this evolving market setting,” Grandhi added.